The Best Strategy To Use For Commercial Insurance In Toccoa Ga

Some monetary experts offer estate planning solutions to their clients. It's crucial for economic advisors to stay up to day with the market, financial problems and advising ideal methods.

To offer financial investment products, advisors need to pass the pertinent Financial Industry Regulatory Authority-administered exams such as the SIE or Series 6 tests to get their certification. Advisors who want to market annuities or various other insurance products should have a state insurance policy license in the state in which they prepare to offer them.

The Insurance In Toccoa Ga PDFs

You employ an expert who charges you 0. Since of the normal cost structure, numerous consultants will certainly not function with customers that have under $1 million in assets to be handled.

Capitalists with smaller sized profiles could look for out a financial advisor who charges a hourly charge rather of a portion of AUM. Per hour costs for experts generally run between $200 and $400 an hour. The more complex your monetary circumstance is, the more time your consultant will have to dedicate to managing your assets, making it much more expensive.

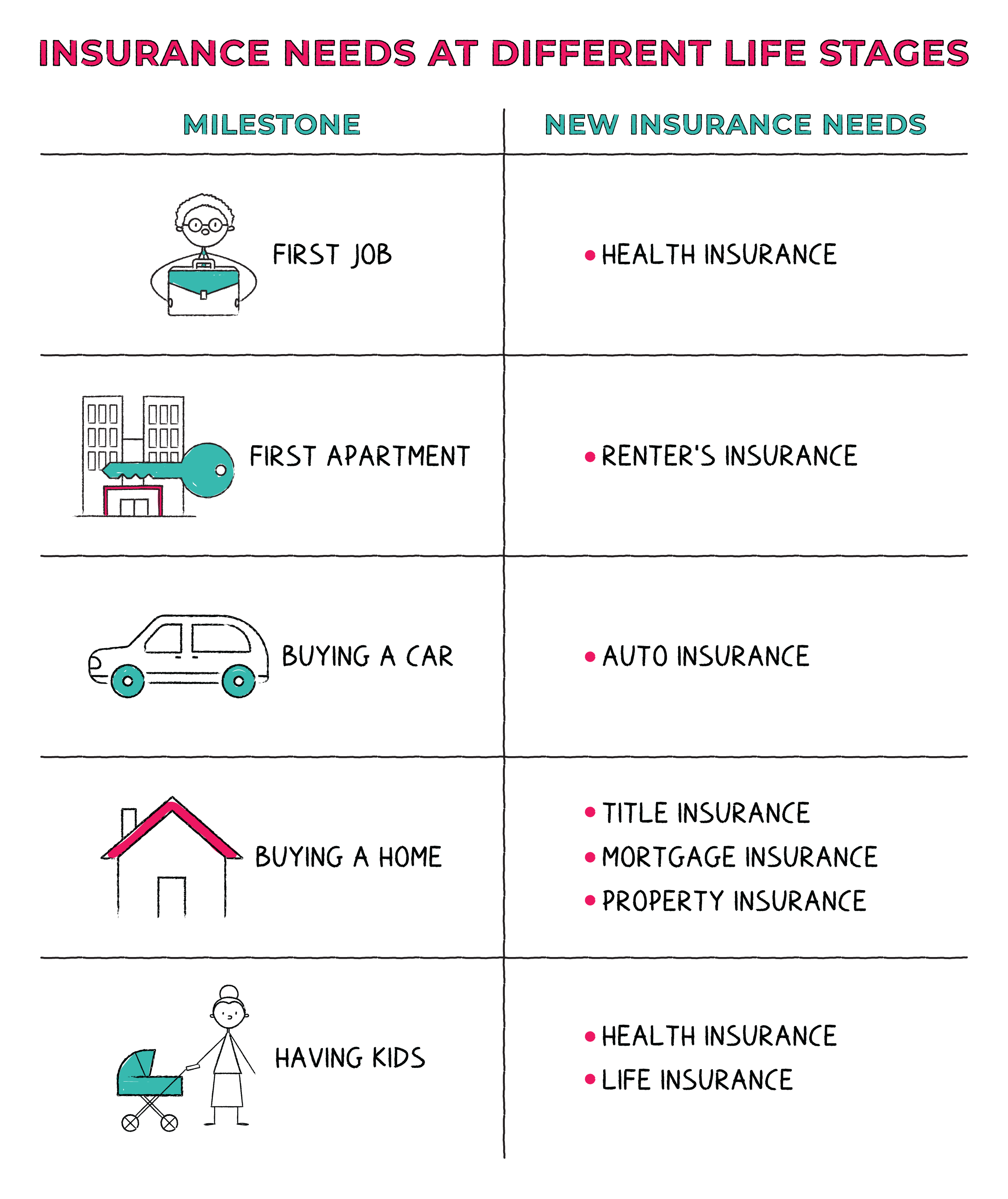

Advisors are competent experts who can assist you establish a prepare for financial success and implement it. You might also consider connecting to an expert if your individual economic conditions have just recently ended up being much more complex. This could mean purchasing a house, marrying, having kids or receiving a large inheritance.

Home Owners Insurance In Toccoa Ga - The Facts

Prior to you meet the expert for an initial examination, consider what services are essential to you. Older grownups might require aid with retired life planning, while younger adults (Final Expense in Toccoa, GA) may be searching for the very best method to spend an inheritance or starting a company. You'll want to choose an expert that has experience with the solutions you want.

The length of time have you been encouraging? What company were you in prior to you entered into economic encouraging? Who composes your normal client base? Can you give me with names of a few of your clients so I can review your services with them? Will I be collaborating this hyperlink with you directly or with an associate expert? You may additionally wish to look at some example economic strategies from the expert.

If all the samples you're supplied coincide or comparable, it may be an indicator that this advisor does not appropriately customize their recommendations for each client. There are 3 main kinds of economic recommending specialists: Certified Monetary Organizer professionals, Chartered Financial Analysts and Personal Financial Specialists - https://jstinsurance1.start.page. The Qualified Financial Planner professional (CFP professional) certification indicates that a consultant has satisfied an expert and honest requirement established by the CFP Board

The smart Trick of Affordable Care Act Aca In Toccoa Ga That Nobody is Discussing

When picking a financial consultant, consider someone with a specialist credential like a CFP or CFA - https://public.sitejot.com/jstinsurance.html. You could additionally consider an advisor who has experience in the services that are essential to you

These advisors are usually filled with disputes of interest they're more salesmen than consultants. That's why it's vital that you have an advisor that works only in your ideal rate of interest. If you're searching for an expert that can really provide genuine value to you, it is essential to investigate a number of potential choices, not simply choose the first name that markets to you.

Currently, many experts have to act in your "ideal interest," yet what that entails can be virtually unenforceable, other than in the most outright cases. You'll require to find an actual fiduciary. "The first examination for a good monetary advisor is if they are benefiting you, as your supporter," says Ed Slott, certified public accountant and founder of "That's what a fiduciary is, however everyone states that, so you'll require other indications than the expert's say-so or perhaps their qualifications." Slott recommends that consumers seek to see whether advisors purchase their continuous education and learning around tax preparation for retired life savings such as 401(k) and individual retirement account accounts.

"They ought to show it to you by showing they have taken major continuous training in retirement tax and estate planning," he says. "You should not invest with any consultant who doesn't invest in their education.